If you recently got a DRUNK DRIVING, after that you might be needed to lug SR22 insurance for the DUI. It is necessary to recognize state SR22 requirements, including when as well as exactly how to submit it, in addition to when you can do away with it - dui. What Is SR22 Insurance DUI? SR22 insurance is a certificate of financial duty.

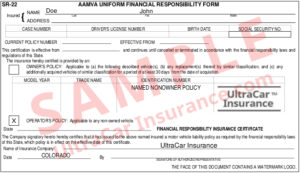

An SR22 is in some cases used to restore a chauffeur's permit following a suspension that includes a drunk driving fee. The type itself shows that you have the minimum insurance protection required by your state legislation. SR22 may additionally be described as: Certification of Financial Responsibility, SR-22 Bond, SR-22 Type, SR22SR22 is not a kind of insurance coverage. driver's license.

In some states, you might also be able to obtain it from your insurance coverage supplier. While an SR22 is generally needed when a motorist gets a drunk driving fee, it may also adhere to various other kinds of fees. A few of these consist of driving without insurance, a high event of crashes or relocating infractions, as well as a difficulty license - driver's license.

driver's license motor vehicle safety insurance bureau of motor vehicles driver's license

driver's license motor vehicle safety insurance bureau of motor vehicles driver's license

According to Progressive, an SR22 type is just one consideration when computing your prices. Your insurer will additionally factor in your age, area, driving record, and also credit rating. For this reason, your prices following an SR22 form will vary from service provider to company. Along with filing an SR22, some states may likewise call for drivers founded guilty of a DUI to also complete a motorist security training course to restore their license - ignition interlock.

sr22 insurance dui auto insurance coverage insure

sr22 insurance dui auto insurance coverage insure

How much time Do I Need an SR22 For? The moment requirements of an SR22 will certainly differ, depending on your state legislations. On average, a lot of states need vehicle drivers with a DUI to submit an SR22 for three years after their charges. Depending on the variety of DUIs on your record, your state can require you to file an SR22 permanently.

When your time limit is up, it is crucial to note that the SR22 will certainly not simply drop off your document on its own. Rather, you will certainly have to request that your insurance policy firm get rid of the form.

Not known Factual Statements About Sr-22 Insurance Irvine, California

This is recognized as a non-owner SR22 form. Even if you only have accessibility to a family members vehicle, you may still think about getting a non-owner SR22 plan. Relocating to a Various State with an SR22 Form, Because state regulations vary when it pertains to a DUI and SR22 types, you will certainly require to investigate your new state's needs if you relocate.

In these states, they might have their very own variation of the SR22 kinds or they may simply need that you provide proof of insurance coverage. ignition interlock. When you submit it to your insurance policy firm, they will add the insurance coverage recommendation to your policy as well as alert the state that you have sufficient insurance.

Right here are a few insurance firms that do offer SR22 policies: Mercury, GEICOUnited, CSAAFarmers, Allstate, Progressive, State Farm, It is always a good suggestion to be sincere when requesting quotes from insurance companies. An SR22 is likely to have some result on your rates suggesting you will certainly get the most exact quotes when you discuss it ahead of time.

Shopping about is just one of the most effective means to get the most inexpensive prices, despite an SR22. Find out exactly how much each provider will cost you, contrasting the degree of coverage used with the price. Furthermore, figure out if you are qualified for any discount rates which can minimize your insurance coverage prices a lot more.

Which states require SR-22s? Each state has its very own SR-22 coverage demands for drivers, as well as all go through change. Connect with your insurance company to discover your state's present needs and make certain you have appropriate protection. For how long do you need an SR-22? The majority of states require drivers to have an SR-22to confirm they have insurancefor concerning three years.

sr22 coverage ignition interlock coverage dui

sr22 coverage ignition interlock coverage dui

Secret things to learn about SR-22 insurance prior to buying., Vehicle Insurance policy Author, Feb 18, 2022 - insurance group.

Indicators on Sr-22 Insurance- What Is It And How Does It Work? - Geico You Should Know

Some examples include: A DUI or DWIReckless driving Driving without insurance policy, Repetitive relocating offenses Falling short to pay kid assistance, Serious moving infraction sentences Just how Long Does It Take to Reinstate a License? The timeline for obtaining your permit renewed differs substantially from state to state and also the factor for the suspension.

If your license was suspended due to a moving violation, you could be required to take a defensive driving course. In some instances taking a driving program may help you to get your certificate back faster (division of motor vehicles). Also if it is not required, consider it will aid to reduce your insurance policy premiums, which will likely be higher adhering to a certificate suspension.

SR-22 insurance works as proof to your state that you lug the minimum obligation insurance policy coverage needed. Many insurance service providers will certainly submit the SR-22 with the state on your behalf. You will certainly probably have to pay fees to have your license reinstated (insure). The quantity varies dramatically based upon the state in which you live and also the factor for the suspension.

Pocketbook, Center provides a practical graph, which describes requirements and also filing durations by state. The declaring period indicates the length of time needed to hold continuous insurance policy coverage and also keep the SR-22 on documents. dui. Expect you terminate your insurance coverage at any type of factor within the term or let it gap.

What Do I Required to Know When it Comes to Getting Insurance after a Certificate Suspension? A permit suspension can influence your insurance coverage search in a number of ways. coverage. You may face higher costs as you could be thought about a high-risk motorist. You may need to consider a high-risk insurance policy service provider due to the fact that your existing company might no more cover you.

While it is always easier to restore your existing policy, it might profit you to get in touch with various insurance coverage service providers after a permit suspension. This will help you identify which insurance provider will certainly supply you the most effective prices. Get prepared to hit the trail again with a vehicle insurance coverage from Vern Fonk.

Top Guidelines Of How Long Do I Need Sr22 Insurance?

An SR22 is a form issued by an insurer that informs a state that you have the minimum insurance coverage needed in that state after getting your driving advantages back. department of motor vehicles. It is not insurance or insurance coverage, yet a means your state ensures your car insurance coverage is energetic. Trick Takeaways An SR22 is a type your vehicle insurance policy business sends out to the state so you can follow court- or state-ordered requirements.

SR22s can be filed with both typical insurance coverage policies as well as non-owner insurance policy. This document verifies that you have actually fulfilled your monetary obligation for having the minimal liability insurance policy coverage.

You'll require to have an SR22 type from your insurance provider if your certificate has actually been put on hold or revoked and your privileges have been renewed. If your insurance policy undergoes any type of significant modifications or terminations, your insurance coverage service provider will inform the state. You may require to maintain an SR22 for a collection period, such as three years.

You call your insurance coverage carrier, and also they should issue you the type when you have bought the minimum amount of automobile insurance. You'll need to keep the minimum amount of coverage and make certain you have a current SR22 kind for the duration established by the state you reside in.

The SR22 can set you back concerning $25 in filing charges. SR22 may lead to a boost in insurance costs by in between 20% as well as 30%. An SR22 provided for uninsured driving is around $30 and can depend upon your credit history.

If you do not have a car but have to submit an SR22 as a result of a sentence, you'll require to ask your representative about a non-owner policy. These policies cover your driving when you drive somebody else's car or a rental and also expense less than guaranteeing an automobile. If you change insurance provider while you have an SR22, you'll require to submit for a brand-new SR22 prior to the very first strategy expires. auto insurance.

8 Simple Techniques For Sr22 Insurance In Oregon State And What You Need To Know

This type informs the state about the adjustment. Obtaining the declaring got rid of might lower your prices on your insurance - auto insurance. Exactly how Do I Discover Out if I Still Need SR22 Insurance Coverage?

In some states, if you terminate your SR22 declaring early, you may be needed to restart the period over once more, also if you were only a few days from the date it was established to expire.

Evidence of insurance coverage is filed by providing a SR22 certification to DMV. To acquire a SR22 certification, speak to an insurer certified to do company in Wisconsin. Most insurer that submit SR22 certificates will digitally file or mail the information to DMV. The online submitted details is typically gotten in immediately on the customer's motorist document within one to 2 working days.

You might need an SR22 filing before you can obtain your driver's license restored. insurance companies. An SR22 is a merely a state declaring that is included to an insurance policy.

The SR22 filing is an accessory to the automobile insurance policy. Some business may charge a simple filing cost for the SR22Some business will bill a surcharge point system. Individuals ask us, "For how long do I require to bring the SR22 filing!.?.!?"Sadly, the length of time is determined by the division of automobile and the courts.

In many cases, the judge orders a motorist to acquire an SR22 Insurance policy when that chauffeur has received a sentence for hazardous driving. Several various infractions might cause a court order for an SR22. These include: Driving While Intoxicated (DWI,) Driving Under the Influence (DUI,) driving with no insurance coverage, or having an excessive number of traffic offenses in a short period.

Excitement About Sr-22 And Insurance After Dwi - Travis Noble

Some insurance coverage companies do not provide this kind of insurance coverage, as it is regarded "high threat" insurance policy - insure. Numerous regional insurance policy agents can advise a representative that might function with high-risk clients. Lots https://what-is-sr-22-insurance-who-needs-it.nyc3.digitaloceanspaces.com of Internet-based insurance coverage firms are currently using certificates too. SR22 coverage is a lot more pricey than a normal insurance coverage policy.

Nonetheless, for the individual who needs insurance coverage to stay on the road, this additional cost is more than worth it. We can discover the most affordable expense readily available. SR22 Insurance Coverage in South Carolina can differ widely from someone to the following concerning costs. Some aspects that might play right into the ultimate cost of the policy normally include: The total driving document of the vehicle driver, both previously as well as after the sentence: If the conviction were an one-time point, the prices would certainly be lower.

The credit report score of the driver: Greater credit rating will certainly often yield much lower prices, both with common cars and truck insurance coverage and with SR22. The miles driven per month or year: The fewer miles, the reduced the price will normally be. The area: Some areas of the U.S. have higher criminal activity prices, as well as these areas typically have higher insurance rates as well.

sr-22 sr-22 insurance group bureau of motor vehicles sr22

sr-22 sr-22 insurance group bureau of motor vehicles sr22

Age: Individuals over 25 years old generally obtain less expensive rates than more youthful drivers in several situations, something that holds true with virtually all kinds of policies. Sex: Females are statistically deemed to be safer chauffeurs, and therefore often receive more affordable SR22 rates. Marriage standing: Individuals that are wed normally receive an added discount rate on their lorry insurance coverage, as they are deemed to be extra careful drivers.